single life annuity vs lump sum

Learn some startling facts. But at retirement people should.

Life Insurance Vs Annuity How To Choose What S Right For You

Individuals who already have sufficient income sourcesthrough Social Security other pension benefits or a large portfolio might find an.

. While life insurance seeks to provide an individuals family with a lump-sum fiscal payout when that individual dies. External Links Disclaimer If you. Annuity Calculator from North American Savings Bank to help determine whether its better to get a lump sum or receive an annuity.

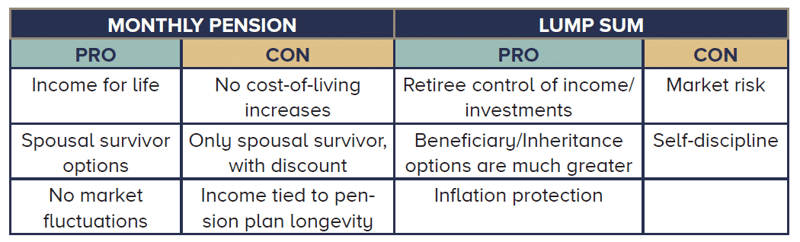

Both options offer retirees. Regardless of what your financial advisor or agent recommends. Your lump sum vs annuity decision comes down to if you need a lifetime income stream or not.

People trying to decide between a lump sum or an annuity often focus on whether they could earn more by investing the lump sum Russell says. Not surprisingly the monthly payout will be higher with a single-life annuity than if you opt for the joint-and-survivor benefit because the expected payment period is longer. Ad Learn More about How Annuities Work from Fidelity.

This is a good check on our math as both the Annuity and Lump Sum tend to be actuarially similar with a 5 growth rate and an appropriate life expectancy. Projected annual income needs. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

The lump sum in a traditional defined benefit plan is the actuarial. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. With over 10000 baby boomers reaching retirement age every single day many are faced with the decision to take a lump sum dollar amount or an annuity payment from their.

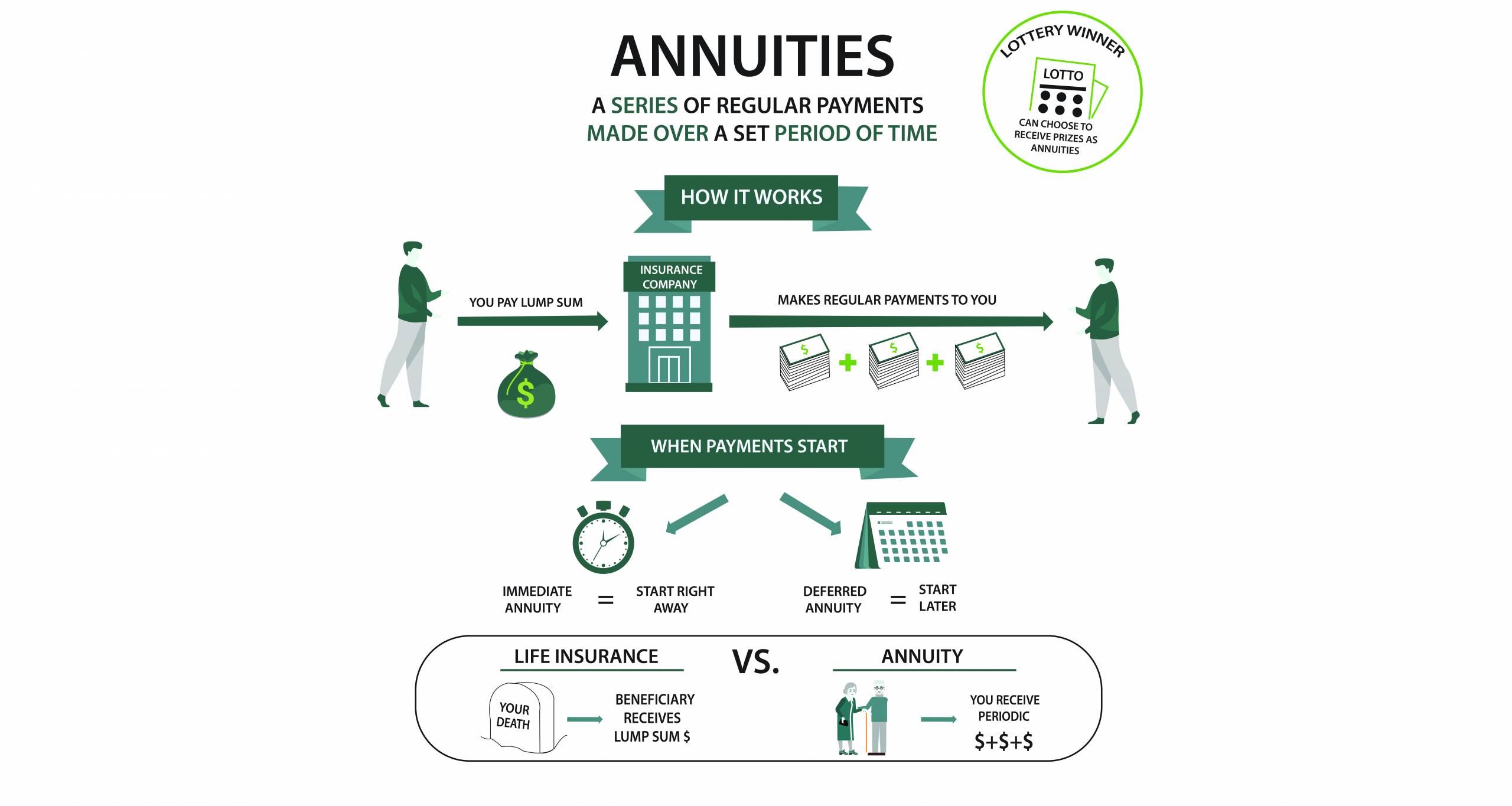

Annuities are often complex retirement investment products. A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life. The lump sum will be large enough that it can have a dramatic impact on.

The end result shows that the present value of the monthly pension is greater than the lump sum using the inputs selected. Ad Learn More about How Annuities Work from Fidelity. A lump sum allows you to collect all of your money at one time.

On the other hand an annuity is a series of steady payments that are made at equal intervals over time. Life Insurance vs. Many plans will allow a participant to elect a single lump sum payment in lieu of future annuity payments.

If you do need. A single-life annuity with no period-certain option will generally give you the largest monthly payment. Use the Lump Sum vs.

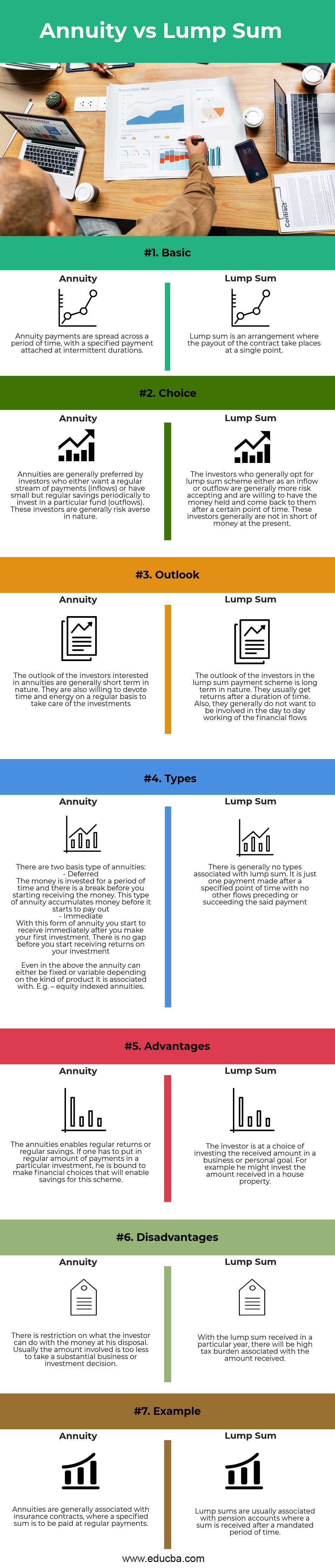

Difference Between Annuity And Lump Sum Payment Infographics

Strategies To Maximize Pension Vs Lump Sum Decisions

Lottery Payout Options Annuity Vs Lump Sum

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

Pension Annuity Vs Lump Sum Which One Is Best

Annuity Vs Lump Sum Top 7 Useful Differences To Know

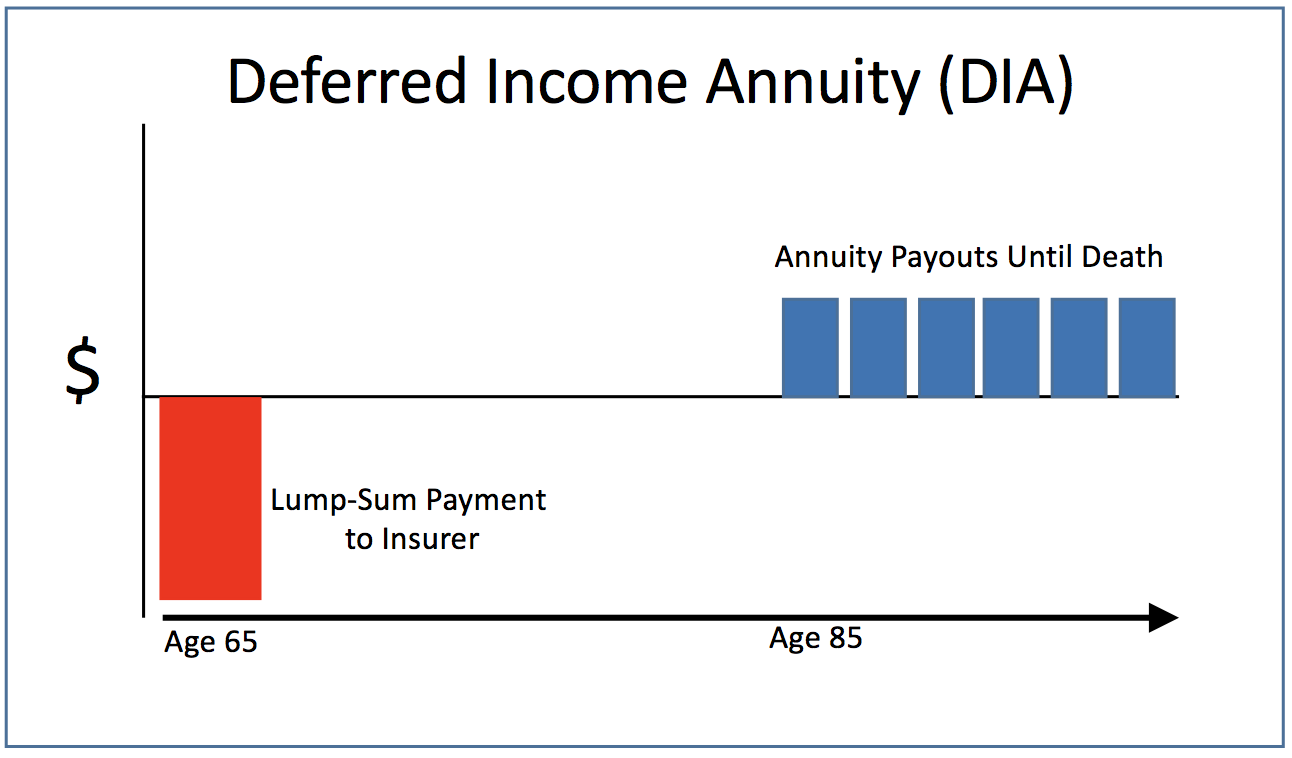

Income Annuities Immediate And Deferred Seeking Alpha

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Does An Annuity Plan Work For You Businesstoday

Annuity Beneficiaries Inherited Annuities Death

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

Period Certain Annuity What It Is Benefits And Drawbacks

Understanding Your At T Pension For Retirement

Strategies To Maximize Pension Vs Lump Sum Decisions

What Is An Annuity Rates Types Pros Cons

When Can You Cash Out An Annuity Getting Money From An Annuity

Annuity Payout Options Immediate Vs Deferred Annuities

Strategies To Maximize Pension Vs Lump Sum Decisions

Difference Between Annuity And Lump Sum Payment Infographics